There are two ways to set taxes in commercebuild - via integration with Avalara, or by using your ERP. In this article, we'll look at how the commercebuild platform uses the ERP to set taxes.

For B2B customers, we read each account's tax rate from the ERP. If you automatically get correct taxes when manually building orders in your ERP, then we should see your B2B customers on the commercebuild platform get charged the correct taxes too. There is typically no configuration for B2B clients. If you sell products with an environmental handling fee and want to use the ERP's tax settings to charge this fee, you should contact us.

For B2C customers, they don't have their own ERP accounts to draw tax information from. We can create a surrogate account for your B2C users based on geography. Note that the smallest geographic area would be the State/Province level. Typically, this means it's not suitable for US customers. A single State could have multiple rates. We strongly recommend Avalara for US clients.

Prerequisites

You should have set up your shipping already, and you will need to have added zones in a carrier.

You'll need to set up the surrogate tax accounts. For Canadian clients, we recommend you set up an ERP account for every province and territory. In these surrogate accounts, set them up with their tax rules, as you would any client.

Setup

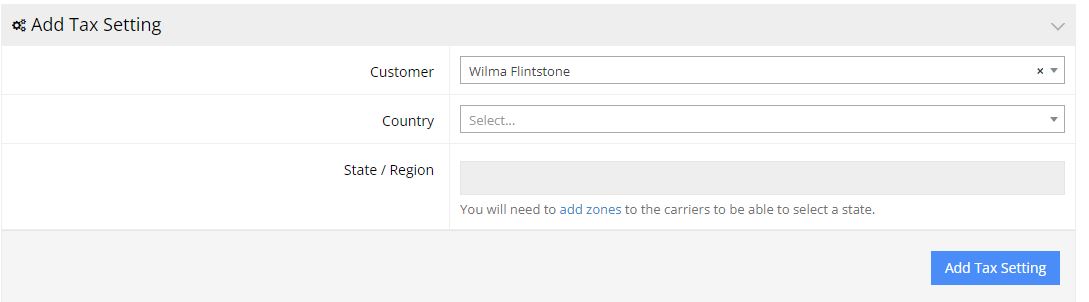

In your admin panel, go to System >> Tax Setting.

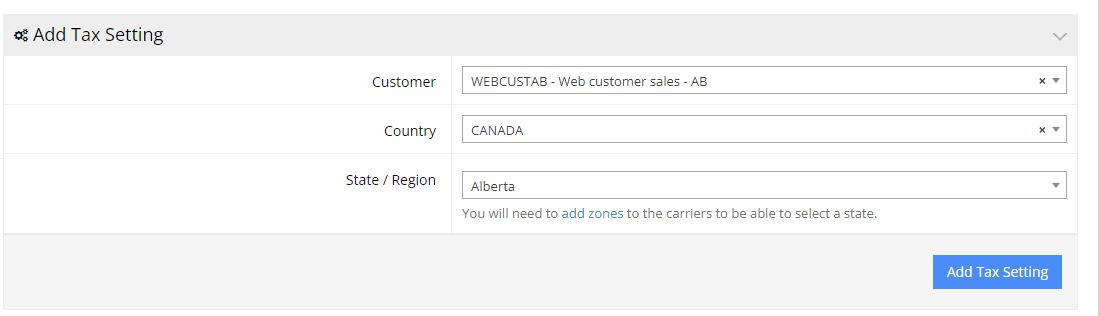

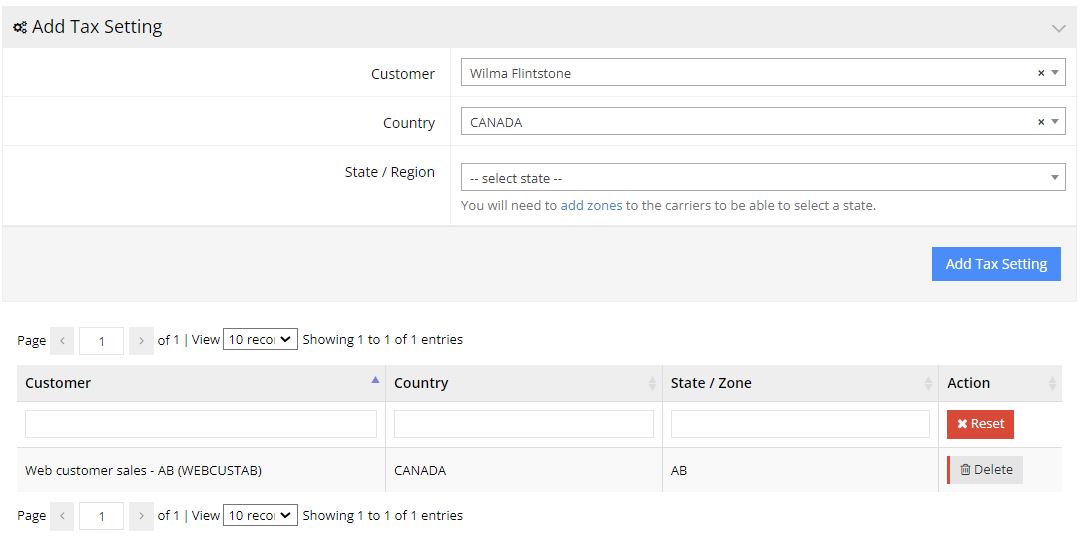

From the Customer field, select the first surrogate account, select the country, and State/Region. Here's an example for Alberta:

Click on Add Tax Setting. You'll see you've now entered a record for the province of Alberta. Any time a B2C or guest user checks out with a ship-to address in the province of Alberta, the commercebuild platform knows where to look for instructions on how to charge tax.

Repeat these steps until you've covered the geographic area you service and that you have a tax-collecting requirement for.